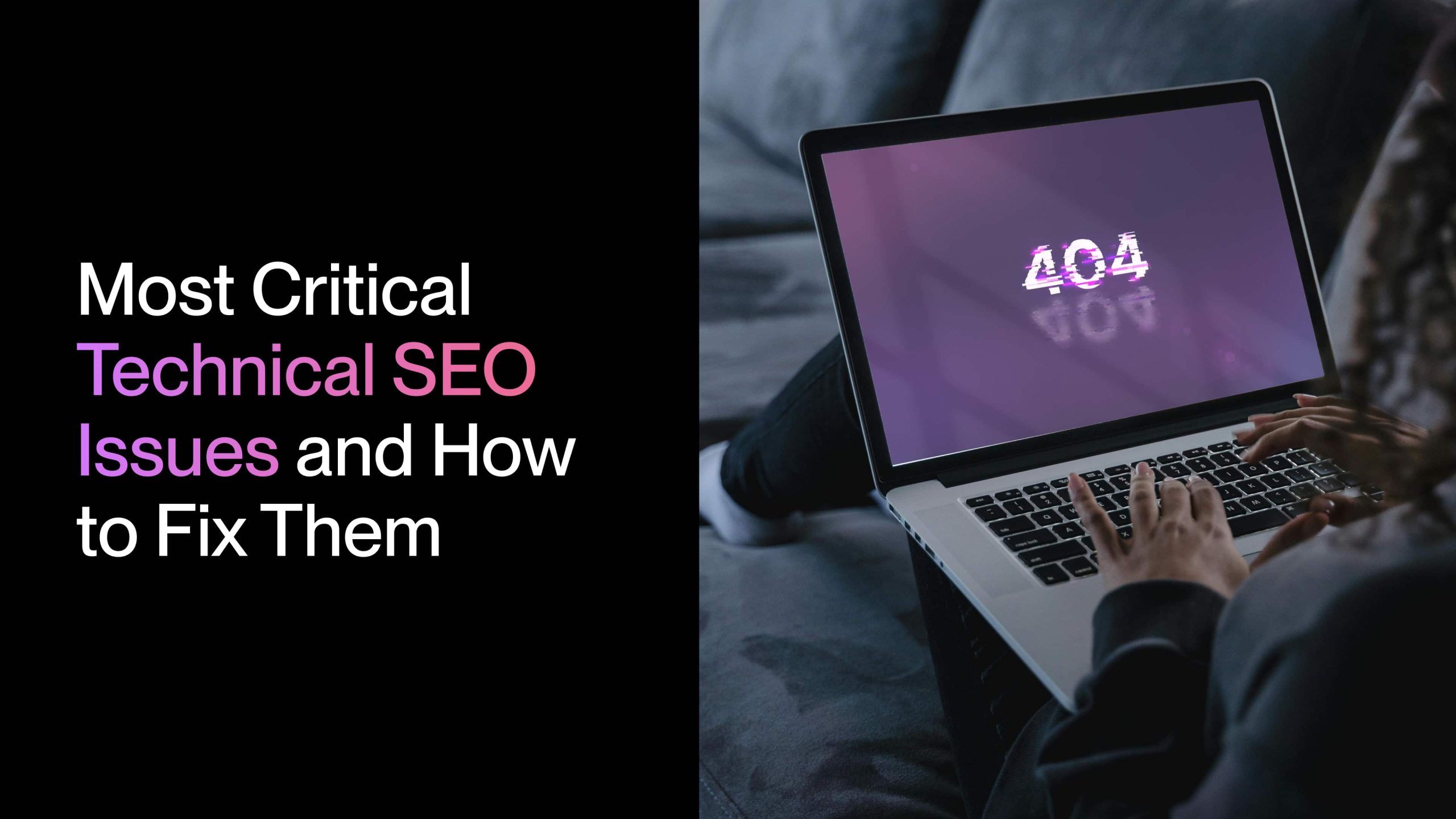

Your fintech product works. It solves the problem. Payment processing that doesn’t randomly fail on Fridays, compliance automation that legal teams don’t immediately reject, risk management that catches fraud before it becomes a headline. The tech isn’t your issue.

Marketing it? That’s where B2B fintech businesses hit a wall.

Enterprise buyers ghost your demos. Your pipeline fills with prospects who’ll “circle back next quarter” (they won’t). Sales keeps asking when marketing will send leads that close. Meanwhile, your competitor with the clunkier product just landed three enterprise clients because somehow their marketing doesn’t put people to sleep.

Here’s what’s happening. B2B fintech marketing plays by different rules than selling productivity software or marketing tools. Your buyers need sign-off from IT, legal, compliance, and three levels of executives before anyone touches a contract. One data breach makes headlines and your pipeline vanishes overnight. Trust takes six months to build and one LinkedIn comment to destroy. And the financial services industry just watched funding rebound 35% year-over-year in 2025 — but that money went to mature B2B fintech businesses proving sustainable growth, not startups burning cash on Facebook ads.

Investors prioritize companies enabling digital transformation over those offering incremental improvements to legacy systems.

The stakes couldn’t be higher. Fintech leads all B2B sectors with an average CAC of $1,450 per customer — climbing to $14,774 for enterprise deals. Every misstep in your marketing strategy doesn’t just waste budget; it potentially kills deals that took months to develop.

The buyer behavior shift makes this harder. Gartner found that 61% of B2B buyers now prefer researching and evaluating solutions without ever talking to sales. They want to self-educate, compare options, and make decisions on their timeline. Great for them. Tough for you when you’re selling payment systems or digital wallets that require explaining regulatory compliance, financial data security, and integration complexity that can’t fit in a 2-minute explainer video.

“B2B fintech marketing differs from traditional B2B in its complexity and focus on long-term relationships. Buyers in fintech are typically looking for secure, scalable solutions that align with regulatory requirements. This leads to longer sales cycles, more technical due diligence, and a focus on ROI.”

Kseniya V, Marketing Strategist at Ninja Promo

Most B2B fintech marketing advice treats you like you’re selling generic SaaS. “Just do content marketing!” Sure, because explaining PSD2 compliance in a blog post is exactly like writing about project management tips. “Try account-based marketing!” Right, because enterprise clients making seven-figure decisions respond to the same tactics as mid-market software buyers.

This guide tackles the challenges — positioning complex B2B fintech solutions to enterprise clients who’ve seen every pitch deck, building thought leadership content that moves decision-makers instead of just racking up LinkedIn impressions, proving ROI when customer acquisition costs keep climbing, and mapping a buyer journey that accounts for long B2B sales cycles where deals stall in legal for three months.

We’ve worked with B2B fintech businesses long enough to know what separates the ones who scale from the ones stuck explaining their value proposition for the hundredth time while competitors eat their lunch. The difference isn’t better tech or bigger budgets. It’s marketing that understands how enterprise clients buy financial technology — and meets them where they are.

Understanding B2B Fintech Marketing

Most B2B fintech companies market like they’re selling consumer apps or generic enterprise software. Neither works. The financial services industry runs on trust built over decades, regulatory frameworks that punish mistakes ruthlessly, and buying committees where one skeptical voice kills deals. Your marketing needs to account for all three.

What Is B2B Fintech Marketing?

B2B fintech marketing convinces other businesses to route their money, data, or compliance workflows through your technology. You’re not asking someone to download an app — you’re asking a CFO to replace payment systems handling millions in transactions monthly, or a compliance officer to bet their job on your regulatory tech.

The buyer journey touches more departments than typical software deals. IT reviews your API documentation. Legal redlines contracts for three months. Compliance verifies you meet data privacy regulations across seven countries. Finance builds ROI models. Procurement negotiates terms. Every stakeholder needs different proof points before signing off.

This means your marketing translates technical capabilities into outcomes each role cares about. Engineers want to see your webhook architecture. Business buyers want to know if you’ll pass security review without derailing their Q4 launch. Skip either audience and your pipeline stalls.

What Makes B2B Fintech Different from B2C Fintech

B2C fintech sells convenience through app stores. Download, link your bank, start budgeting. Viral loops work. Influencer partnerships work. Clever copy about “taking control of your finances” works.

Try any of that when selling payment systems to enterprises and watch your credibility evaporate. B2C chases volume (get a million users, monetize 5%). B2B fintech marketing chases depth — land one bank, prove value over 18 months, expand into other divisions, turn them into the case study that opens doors to their competitors.

“Compared to B2C fintech, where impulse buys rule (e.g., downloading a budgeting app), B2B demands a more consultative approach with trust-building through case studies and demos, rather than flashy ads. The sales cycles are longer and more detailed, with messaging focused on delivering tangible business outcomes — like cost efficiency and compliance — rather than user engagement.”

Kseniya V, Marketing Strategist at Ninja Promo

The decision-making gap matters more than companies realize. B2C buyers hit “download” based on Instagram ads. B2B buyers form evaluation committees — and according to Forrester, the average B2B purchase now involves 13 stakeholders, with 89% of buying decisions crossing multiple departments.

You’re building consensus across people who’ve never met and often disagree on priorities — technical teams worried about integration nightmares, legal parsing contract liability, compliance checking regulatory boxes, executives tracking revenue impact. Your messaging needs to work for all of them without sounding like committee-written corporate speak.

Core Components of B2B Fintech Marketing

Positioning that differentiates. Every competitor claims “secure, scalable, compliant.” Your value proposition needs to explain why your specific approach to digital wallets or lending infrastructure solves problems others miss. This feeds everything else.

Thought leadership content proving expertise before demos. Buyers research independently so your content answers their questions first. Technical implementation guides. Regulatory analysis. Market research. Case studies with numbers that survive scrutiny.

Multi-channel presence where decision-makers spend time. Effective omnichannel marketing coordinates LinkedIn for executive relationships, industry publications for credibility. Webinars for complex education. Strategic B2B SEO capturing high-intent searches. Email nurturing through 9-month sales cycles. Consistency matters more than coverage.

Proof points addressing specific concerns. Security certifications legal teams recognize. Integration capabilities that won’t derail roadmaps. Compliance documentation satisfying auditors. References from companies they respect. ROI data built on conservative assumptions.

Sales enablement bridging marketing to close. Battle cards for competitive situations. Pitch decks customized by persona. Demo environments showcasing relevant use cases. Frameworks handling common objections. Your marketing doesn’t stop when someone books a call.

Key Challenges in B2B Fintech Marketing

| The Challenge | The Reality | The Fix |

| Trust | • One security breach ends you

• Buyers need financial infrastructure reliability • Vague claims = ignored |

• Specific certifications (SOC 2, ISO 27001)

• Third-party audit results • Named security review examples |

| Complexity | • COO has 10 minutes

• Engineers need technical depth • Can’t oversimplify OR over-complicate |

• Layered content by audience

• Business outcomes for execs • Technical specs for evaluators |

| ROI Proof | • 57% expect ROI in 3 months

• 11% demand immediate returns • Value compounds over time |

• Conservative projections

• Comparable implementation data • Monthly value breakdown |

Trust when mistakes end companies. One breach, one compliance failure, one system outage during market close — any of these sinks B2B fintech businesses overnight. Buyers know this. They’ve watched competitors pick the wrong vendor and pay the price. You’re not marketing software; you’re asking them to trust you with their business’s financial infrastructure. That’s why vague security claims get ignored while specific certifications and third-party audits open doors.

“Fintech companies consistently struggle with three main challenges in their B2B marketing: educating their target audience, building trust, and proving ROI. The financial industry is full of complex jargon, making it difficult for companies to communicate their value clearly without losing credibility.”

Kseniya V, Marketing Strategist at Ninja Promo

Translating complexity for business buyers. Your payment systems might use sophisticated fraud detection algorithms and real-time settlement optimization. Now explain that value to a COO who has 10 minutes for your pitch. Most B2B fintech marketing either drowns business buyers in technical specifications or oversimplifies until technical evaluators dismiss you as superficial. The sweet spot — demonstrating depth without requiring engineering degrees to grasp your value — separates companies that scale from those stuck explaining basics.

Proving ROI before pilots run. Best B2B fintech solutions compound value monthly — fraud losses prevented, compliance penalties avoided, payment margins improved incrementally. But enterprise clients want proof upfront, before you’ve integrated with their systems.

The timeline pressure intensifies this challenge. G2’s research shows 57% of B2B buyers expect ROI within 3 months of purchase, with 11% demanding immediate returns. Your marketing needs frameworks projecting conservative ROI based on comparable implementations, not aspirational case studies from ideal conditions.

BCG research shows investors now demand sustainable unit economics over growth-at-all-costs, shifting buyer expectations toward long-term viability. Your marketing needs frameworks projecting conservative ROI based on comparable implementations, not aspirational case studies from ideal conditions.

Positioning and Messaging for B2B Fintech

Your product’s technical superiority means nothing if you can’t articulate why it matters to the people signing checks. B2B fintech companies often confuse explaining what they built with communicating the value it delivers. The first loses deals to competitors with inferior tech but clearer messaging. The second fills pipelines.

Crafting a Clear Fintech Value Proposition

Walk through ten B2B fintech company websites and you’ll see the same value proposition recycled with minor word swaps. “We help financial institutions streamline operations through innovative technology.” “Our platform empowers businesses to optimize financial workflows.” “Transform your payment infrastructure with our cutting-edge solution.”

None of this means anything. You’re listing capabilities, not solving problems.

A strong value proposition answers three questions before someone scrolls: What specific business problem do you fix? For which type of buyer? And why should they trust you over the five competitors in their other browser tabs?

“To strike the right balance, it’s crucial to focus on translating technical innovations into clear business outcomes. Decision-makers are less concerned with the underlying tech stack and more interested in how it can solve real-world problems, such as improving efficiency, reducing costs, or driving revenue growth.”

Kseniya V, Marketing Strategist at Ninja Promo

Lead with outcomes, not architecture. “We cut payment processing costs 40% for mid-market e-commerce companies handling cross-border transactions” opens more doors than “Our AI-powered payment optimization platform leverages machine learning algorithms for intelligent routing.” Both might be accurate. One gets meetings. The other gets skipped.

The layered approach works best — executives see business impact on your homepage, technical teams find integration specs in your docs, procurement gets ROI calculators showing conservative projections. Each audience gets depth where they care about it without forcing CFOs to wade through API documentation or making engineers guess at business value. Understanding the full B2B customer journey map helps you position different messages at each stage of their research.

Communicating Trust, Security, and Compliance

Most fintech marketing sounds like everyone took the same compliance training. “Security is our top priority.” “We take data protection seriously.” “Your information stays safe with us.”

Every vendor claims this. None of it builds trust.

Trust comes from specifics, not reassurance. List your SOC 2 Type II certification date. Detail which frameworks you’re audited against — ISO 27001, PCI DSS Level 1, GDPR Article 32 technical measures. Name the third-party firms running your annual penetration tests. Show the audit documentation that satisfied your last three enterprise security reviews.

The trick is making this accessible without turning your website into a compliance manual. Nobody reads 2,000 words about encryption protocols on your homepage. But buyers hunting for proof need to find it fast — dedicated security pages, technical appendices in case studies, detailed documentation your sales team shares during evaluation.

Shift from defensive to proactive. Instead of promising you won’t lose data, show how your approach to financial data security stopped specific attack vectors during real deployments. One B2B fintech company we know publishes quarterly security reports detailing threats they blocked and how. Their win rate in competitive deals jumped because buyers saw evidence instead of promises.

Regulatory compliance works the same way. Don’t claim you “handle compliance” — specify which regulations matter for your market segmentation (SOX for public companies, GDPR for EU operations, state-level data privacy regulations for US markets) and demonstrate your audit trail. When you can show a prospect that your last implementation passed their industry’s toughest compliance review in 6 weeks instead of the usual 6 months, you’ve turned a checkbox into a competitive advantage. Strong fintech SEO ensures buyers researching compliance requirements find your detailed documentation before they ever talk to sales.

Differentiating Your Fintech Product in a Crowded Market

The competitive landscape keeps getting messier. Payment platforms, lending infrastructure, compliance automation, fraud prevention — every category drowns in options. Dozens of established players, hundreds of funded startups, all claiming they’re different.

Feature-based differentiation dies fast because competitors copy what works within a quarter. “Real-time analytics dashboard!” Welcome to table stakes. “AI-powered insights!” So does everyone else now. “Seamless integration!” That’s not differentiation, that’s the minimum viable product.

Sustainable fintech product positioning comes from combinations competitors can’t easily replicate. Maybe you’re the only payment processor that handles Islamic finance compliance requirements. Maybe your lending platform integrates with legacy core banking systems that everyone else gave up on. Maybe you’re not the feature leader but you implement it in 4 weeks while competitors need 6 months.

Strong differentiation often means narrowing focus until you own something specific. “Payment processing for all businesses” loses to “recurring billing infrastructure built for B2B SaaS companies with complex pricing tiers and multi-currency requirements.” You shrink your addressable market. You win the customers who fit because your messaging speaks to their exact situation instead of generic pain points that could apply to anyone.

Pick the market position that plays to your actual strengths and matters to your target audience analysis, then defend it relentlessly. Maybe you’re not the cheapest option but you’re the only one that survived a Big Four bank’s security review on first submission. Maybe you’re not the most comprehensive platform but your customer retention rate is 97% because you nail the three features that matter most. Maybe you serve fewer industries but you know healthcare billing regulations better than competitors serve any vertical.

Your positioning should make it obvious who you’re for and who you’re not. The clearer you are about both, the faster you close deals with the right buyers and stop wasting cycles on prospects who’ll never convert. Staying ahead of B2B marketing trends helps you spot emerging differentiation opportunities before markets get saturated.

Crafting a High-Impact B2B Fintech Marketing Strategy

You can build the world’s most beautiful strategy deck. Seventy slides with market analysis, competitive positioning matrices, channel allocation frameworks. Present it to your board, get approvals, file it in SharePoint, and watch it accomplish exactly nothing because nobody executes on it.

Or you can skip strategy entirely and just start running tactics. LinkedIn ads because that’s what everyone does. Content because you need to “build thought leadership.” Events because your VP saw competitors at that conference. Six months later you’ve burned $300K and your CEO’s asking why marketing hasn’t generated any pipeline.

Your B2B fintech marketing strategy needs both parts working — a framework that guides which bets to make and the discipline to measure what’s paying off before you double down.

Defining and Segmenting Your Target Audience

Here’s the mistake that tanks fintech marketing strategies before they launch: targeting “financial services companies” or “businesses that need payment processing.”

That’s not a target audience. That’s half the economy.

“A common mistake is targeting too broad an audience, either by focusing on the entire financial sector or aiming for too many industries at once. This dilutes the messaging and makes it harder to create tailored solutions that truly resonate with a specific group.”

Kseniya V, Marketing Strategist at Ninja Promo

Effective market segmentation gets specific enough that your messaging feels custom-built. Not “CFOs” — try “CFOs at $50M-$200M manufacturing companies drowning in international supplier payments across 12 currencies who spend 40 hours monthly reconciling transactions manually.” Not “banks” — “regional banks with 10-50 branches watching national players roll out digital features they can’t afford to build in-house.”

See the difference? The narrower your focus, the sharper everything else gets. Your positioning clicks. Your case studies matter. Your competitors sound generic by comparison.

Target audience analysis should dig into firmographics (company size, industry, revenue), technographics (what systems they’re stuck with, what integration nightmares keep their IT team up at night), and behavioral triggers (what finally pushes them from “we should look into this” to “we need proposals by Friday”). When you know your ideal customer started shopping after a compliance audit exposed gaps they didn’t know existed, you build your entire fintech marketing strategy around that moment of panic.

Mapping the Fintech Customer Journey

The buyer journey in B2B fintech doesn’t follow the tidy funnel diagrams marketing platforms sell you. It loops backward when legal gets involved. Stalls for three months during budget cycles. Restarts when a new CTO joins and questions every decision made before their arrival. Involves evaluation fatigue where everyone’s so tired of demos they’re ready to just pick whoever their consultant recommends.

Your customer journey map needs to account for this mess. Early research happens independently — buyers educating themselves before they’ll talk to anyone from your company. Middle stages involve herding cats across departments who’ve never agreed on anything. Late stages focus on contract redlines, security audits that surface new concerns, and integration planning that reveals complexity nobody anticipated during sales demos.

Map this by buyer persona, not generic stages. The technical evaluator stress-testing your API follows a completely different path than the executive sponsor building ROI models for budget committees. Your content distribution channels need to reach both, with messaging acknowledging they care about different outcomes from the same product.

Setting Goals, KPIs, and Success Benchmarks

Most B2B fintech businesses track vanity metrics that feel good but don’t connect to revenue. Website traffic up 40%? Great, did it increase qualified pipeline? LinkedIn followers doubled? Cool, did any of them become customers?

Your fintech marketing strategy needs goals tied to business outcomes. Pipeline generated. Customer acquisition cost by channel. Win rates in competitive deals. Average deal size. Sales cycle length. Expansion revenue from existing accounts. These metrics tell you if marketing drives growth or just activity.

“Beyond standard metrics like MQLs and SQLs, evaluate customer acquisition cost (CAC) in relation to lifetime value (LTV), engagement metrics (such as webinar attendance and follow-up interactions), and sales funnel velocity — assessing the speed at which leads progress from awareness to conversion.”

Kseniya V, Marketing Strategist at Ninja Promo

Set benchmarks using your own historical data, not industry averages that might not apply to your specific B2B fintech solutions. If your current CAC is $15,000 and sales cycles average 9 months, those become baselines for improvement. Track how campaigns impact both — does investing in B2B PPC reduce CAC or just shift budget around? Does better content cut sales cycles by getting buyers to demos already educated?

Understanding Regulatory and Compliance Requirements

Your marketing team can’t ignore regulatory compliance just because they’re not building the product. Every claim you make, every case study you publish, every comparison you draw needs to survive regulatory scrutiny in the markets where you operate.

Different regions have different rules about what you can say. Financial promotions in the UK require specific disclaimers. Claims about returns or performance in the US need substantiation. Data privacy regulations impact how you collect prospect information and run email campaigns. Get this wrong and you’re not just annoying legal — you’re exposing the company to enforcement actions.

Work with your compliance team before launching campaigns, not after. They should review landing page copy, approve customer testimonials, and verify that your performance claims match what you can prove. Yes, this slows things down. It also prevents the nightmare scenario where regulators force you to pull your best-performing campaign mid-quarter because it made unsubstantiated promises about risk management.

Building regulatory compliance into your B2B strategy for fintech marketing from the start costs less than fixing violations later. Plus, being genuinely compliant becomes a competitive advantage when buyers compare you against competitors playing fast and loose with regulations.

Essential Digital Channels for B2B Fintech Marketing

Channel selection matters less than channel execution. B2B fintech businesses spread budgets across every platform their competitors use, then wonder why nothing performs well. Better to dominate two channels than be mediocre on six. Here’s where enterprise clients spend time and how to reach them there.

Content Marketing and Thought Leadership

Publishing content doesn’t make you a thought leader. Publishing perspectives that challenge how buyers think about their problems does. Most B2B fintech content recycles safe observations everyone’s already read. Thought leadership content takes positions, shares specific insights from implementations others won’t discuss publicly, and answers questions buyers research before talking to sales. Technical deep-dives on integration patterns. Regulatory analysis explaining new compliance requirements. Benchmark data showing performance gaps between modern payment systems and legacy infrastructure. Each piece demonstrates you understand their world better than competitors. Content distribution channels matter as much as creation — syndicate to industry publications, share in LinkedIn groups where decision-makers gather, reference in sales conversations.

Email Workflows and Nurture Sequences

Email marketing in B2B fintech requires patience. Sales cycles stretch 6-18 months. Build nurture sequences mapping to buyer journey stages — early sequences educate on problems, middle sequences show solutions addressing challenges, late sequences provide proof points. Segment ruthlessly. CTOs evaluating APIs need different content than CFOs building business cases. Trigger-based workflows outperform time-based sequences. When someone downloads your integration guide, send case studies from similar implementations. When they visit pricing repeatedly, offer ROI calculators. Let behavior guide cadence instead of arbitrary schedules.

LinkedIn and Executive-Level Social Selling

LinkedIn matters because buyers research vendors, vet solutions, and check references before filling out contact forms. Your company page needs consistent activity. Your executives need active profiles showing up in prospect feeds with valuable perspectives. When your CEO publishes regulatory trend analysis, they build credibility with compliance officers. When your CTO shares integration technical deep-dives, they connect with IT directors. Company pages work for announcements. Personal profiles work for relationship building. Use both.

Paid Ads: Google, LinkedIn, Programmatic, Retargeting

Paid advertising works when you target with precision and measure ruthlessly. Google captures intent from active searchers. LinkedIn targets roles and companies through account-based campaigns. Programmatic extends reach across industry publications. Retargeting nurtures prospects who weren’t ready to convert initially. Track performance by channel — some drive volume, others drive quality. Both matter, but quality wins when average deals hit six figures. Strategic use of digital advertising platforms helps you reach decision-makers across multiple touchpoints.

SEO for Fintech: Ranking in Competitive Niches

The competitive landscape for fintech SEO gets brutal in high-value keywords. Instead of fighting for “payment processing,” target specific problems buyers search: “multi-currency payment reconciliation for manufacturers.” Long-tail keywords convert better because they capture specific intent. Someone searching “PCI DSS compliance requirements for payment processors” is actively working on a problem you solve. Technical SEO matters more in fintech — site speed, mobile optimization, structured data, security certificates aren’t optional. They’re table stakes for ranking and passing credibility checks enterprise buyers run before engaging.

Account-Based Marketing (ABM)

Account-based marketing flips traditional B2B demand generation. Instead of attracting thousands of leads, identify your 50-100 ideal enterprise clients and build targeted campaigns reaching decision-makers at those specific companies. ABM works particularly well for B2B fintech businesses with high contract values. When closing one enterprise client generates $500K annually, investing $50K to win that account makes sense. Combine LinkedIn ads reaching executives at target companies, direct mail to stakeholders, customized content addressing industry challenges, and sales outreach. Measure account engagement, meetings booked with target companies, and pipeline from your focus list rather than cost per lead across thousands of prospects.

Leveraging Data and Analytics in B2B Fintech Marketing

Data without action is just expensive dashboards. Every B2B fintech company tracks metrics. Few use them to make better decisions. The difference between marketing that scales and marketing that spins comes down to whether you’re measuring what matters and acting on what you learn.

Marketing Automation and CRM Systems

Your marketing automation and CRM systems should track every touchpoint from first website visit through contract signature. Most B2B fintech businesses pick a platform (HubSpot, Marketo, Salesforce), set it up, then never touch the configuration again.

Here’s what you’re missing. When a prospect downloads your compliance guide at 2am, visits your pricing page three times in a week, attends your webinar then immediately checks your API documentation — these behaviors scream buying intent. Your systems should flag these people for immediate sales outreach, not dump them into the same monthly newsletter everyone gets.

Build workflows that respond to what prospects do, not arbitrary timelines. Someone spending 20 minutes reading your integration docs? Send them case studies from similar implementations, not your generic “Here’s what we do” overview. They’re comparing you against competitors? Provide differentiation guides that address the specific objections your sales team hears repeatedly.

The magic happens when you let prospect behavior guide your next move instead of forcing everyone through identical nurture sequences regardless of what they care about.

Lead Scoring and Pipeline Optimization

Not all demo requests equal qualified pipeline. The enterprise client researching payment systems for 50 locations operates on a different planet than the startup founder comparison shopping before they’ve validated product-market fit.

Your lead scoring model needs to separate them. Weight firmographic fit — company size, industry, revenue range. Track behavioral signals like which content they consumed and how deep they went. Watch for engagement patterns that indicate serious evaluation: multiple stakeholders from the same company researching you, repeated visits over weeks not days, time spent on technical documentation versus marketing fluff.

Most lead generation tactics optimize for volume. You want quality. Pipeline optimization means tracking where deals stall and fixing those leaks before dumping more budget into top-of-funnel activities.

If 60% of qualified leads book demos but only 10% advance to contract negotiation, your demo process needs work — maybe you’re overselling capabilities, or maybe you’re not addressing the concerns that kill deals later. Find the pattern, fix the problem.

Real Case Studies of Successful B2B Fintech Marketing Campaigns

Theory sounds great in strategy decks. Results matter more. Here’s how B2B fintech businesses turned marketing into measurable pipeline growth.

HTX: Scaling Revenue Through Performance Marketing

HTX operates in cryptocurrency exchanges, adjacent to traditional fintech but facing similar B2B challenges. They needed systematic customer acquisition that could scale without falling apart.

We deployed data-driven campaigns across paid channels with relentless testing. Ad creative, landing pages, email nurture sequences — everything got optimized based on what actually moved prospects toward conversion.

The result? $20M in additional client revenue driven by marketing connected directly to business outcomes. Not engagement. Not impressions. Revenue.

Abodos Invest: Precision Targeting for Real Estate Fintech

Abodos Invest couldn’t afford to waste budget on unqualified leads. Their real estate investment platform served a specific audience: accredited investors interested in UK property opportunities.

We built acquisition campaigns targeting exactly that profile. High-intent prospects in specific markets who matched their ideal customer criteria.

The numbers: 65 qualified leads at $118 cost per lead with 7.2% click-through rates. Each lead represented someone who understood what Abodos offered and had the financial qualifications to invest.

Same pattern across all three: target precisely, measure what matters, optimize until the economics work.

Emerging Trends in B2B Fintech Marketing

The fintech growth strategies that worked last year won’t carry you through next year. Markets shift. Buyer expectations evolve. Technology enables approaches that seemed impossible 18 months ago. Here’s what’s changing how B2B fintech businesses reach enterprise clients.

- AI-driven lead generation and qualification. Machine learning now identifies buying signals human marketers miss — patterns in browsing behavior, content consumption sequences, engagement timing that predict which prospects will convert. Tools analyze thousands of data points to score leads more accurately than manual processes ever could.

- Hyper-personalization beyond first names. Generic email blasts died years ago. Now personalization at scale means customizing entire buyer journeys based on industry, company size, tech stack, and specific challenges. Someone from healthcare sees different case studies than manufacturing prospects. Dynamic content adapts in real-time based on what each visitor does.

- Blockchain and DeFi creating new marketing challenges. Decentralized finance marketing opportunities require educating buyers on entirely new concepts while navigating regulatory uncertainty. The financial services industry hasn’t figured out how to message these solutions to traditional enterprise clients still skeptical of cryptocurrency’s stability.

- Privacy-first marketing replacing tracking-dependent tactics. Data privacy regulations keep tightening. Third-party cookies disappear. B2B fintech marketing needs first-party data strategies, permission-based engagement, and value exchanges that make prospects willing to share information rather than tracking them without consent.

- Video and interactive content outperforming static assets. Decision-makers prefer watching 5-minute product walkthroughs over reading 2,000-word whitepapers. Interactive ROI calculators, assessment tools, and personalized demos generate more engagement than downloadable PDFs that sit unread in downloads folders.

The trend underneath all these? Fintech companies that treat buyers like humans with specific problems instead of generic “leads” to process through automated funnels win more deals.

Common Mistakes to Avoid in B2B Fintech Marketing

Some mistakes just waste budget. Others kill credibility so thoroughly that recovering takes years. Here are the ones that consistently tank B2B fintech marketing campaigns — and how to avoid them.

| Mistake | Why It Kills Deals | What to Do Instead |

| Ignoring compliance requirements | One marketing claim that violates financial regulations gets you fined, forced to pull campaigns, and flagged by every prospect’s legal team | Work with compliance before launching campaigns. Get approval on claims, testimonials, performance comparisons. Build regulatory requirements into creative briefs from day one. |

| Poorly defined target audience | Chasing “all financial services companies” dilutes messaging until nobody feels like you built this for them | Narrow focus until your ideal customer profile fits on one page. Target specific industries, company sizes, challenges. Win the customers who fit perfectly. |

| Prioritizing quantity over quality leads | Flooding sales with 1,000 unqualified leads wastes more time than sending them 50 qualified prospects who match ideal customer profiles | Score leads on fit and intent before routing to sales. Track which sources generate customers, not just form fills. Optimize for pipeline quality, not top-of-funnel volume. |

Ignoring Compliance Requirements

Your marketing team might think compliance review just slows down campaigns. Your legal team knows it prevents disasters that end companies. Financial services marketing operates under regulations that don’t apply to other industries. Claims about performance, security, returns — everything needs substantiation and often requires specific disclosures.

One violation doesn’t just get your campaign pulled. It creates a paper trail that surfaces during enterprise sales cycles when prospects’ legal teams do their due diligence. Suddenly you’re explaining to a procurement committee why regulators flagged your marketing practices. That deal’s dead.

Build compliance into your process from the start. Creative briefs should include regulatory requirements. Review cycles should involve compliance before launch, not after complaints arrive. Yes, this slows things down. It also keeps you in business.

Poorly Defined Target Audience

“We serve financial services companies” isn’t a target audience. That’s half the economy. When your positioning tries to appeal to everyone, it resonates with no one.

The narrower your focus, the sharper your messaging gets. “Payment processing for subscription businesses with international customer bases and complex recurring billing” speaks directly to prospects who fit. Everyone else self-selects out, saving your sales team from wasting time on poor-fit prospects.

Target audience analysis should get specific enough that you can name 20 companies matching your ideal profile. If you can’t, you haven’t narrowed enough.

Focusing on Quantity Instead of Quality Leads

Sales teams don’t want 1,000 leads. They want 50 qualified prospects who match your ideal customer profile, have budget, and are actively evaluating solutions. The rest just clogs CRM and wastes follow-up time.

Most lead generation tactics optimize for volume because it makes marketing dashboards look productive. “We generated 2,000 leads this quarter!” Great. How many became customers? How much revenue did they generate? What was the cost to acquire each one?

Quality metrics beat quantity metrics every time in B2B fintech marketing. Track conversion rates, not form fills. Measure pipeline value, not lead count. Optimize for the metrics that survive CFO scrutiny, not the ones that make your team feel busy.

Conclusion

In 2026, B2B fintech marketing demands a strategic blend of technology, personalization, and data-driven insights. By leveraging the latest trends, targeted content, and innovative channels, fintech companies can strengthen their brand, attract high-value clients, and stay ahead of competitors. Adopting a proactive, adaptable approach will be key to driving sustainable growth in an increasingly digital marketplace.